A Chance to Learn More.

Find out more about how our solutions build brand loyalty, increase customer retention, and deliver a proven return on investment.

Case Studies

Auto-Enrollment Case Study: Knoxville TVA Employees Credit Union

How SavvyMoney's Auto-Enrollment feature helped Knoxville TVA Employees...

Loan Application Completion and Funded Loan Increase: PeoplesChoice Credit Union

How SavvyMoney's Offer Engine helped PeoplesChoice Credit Union double...

Pre-Approvals & Funded Loan Success: CU SoCal

How SavvyMoney's pre-approved digital marketing solution led to more than...

Expert Insights

Discovering Financial Wellness the Savvy Way

Discovering Financial Wellness the Savvy Way Americans love spending money, but lately, that...

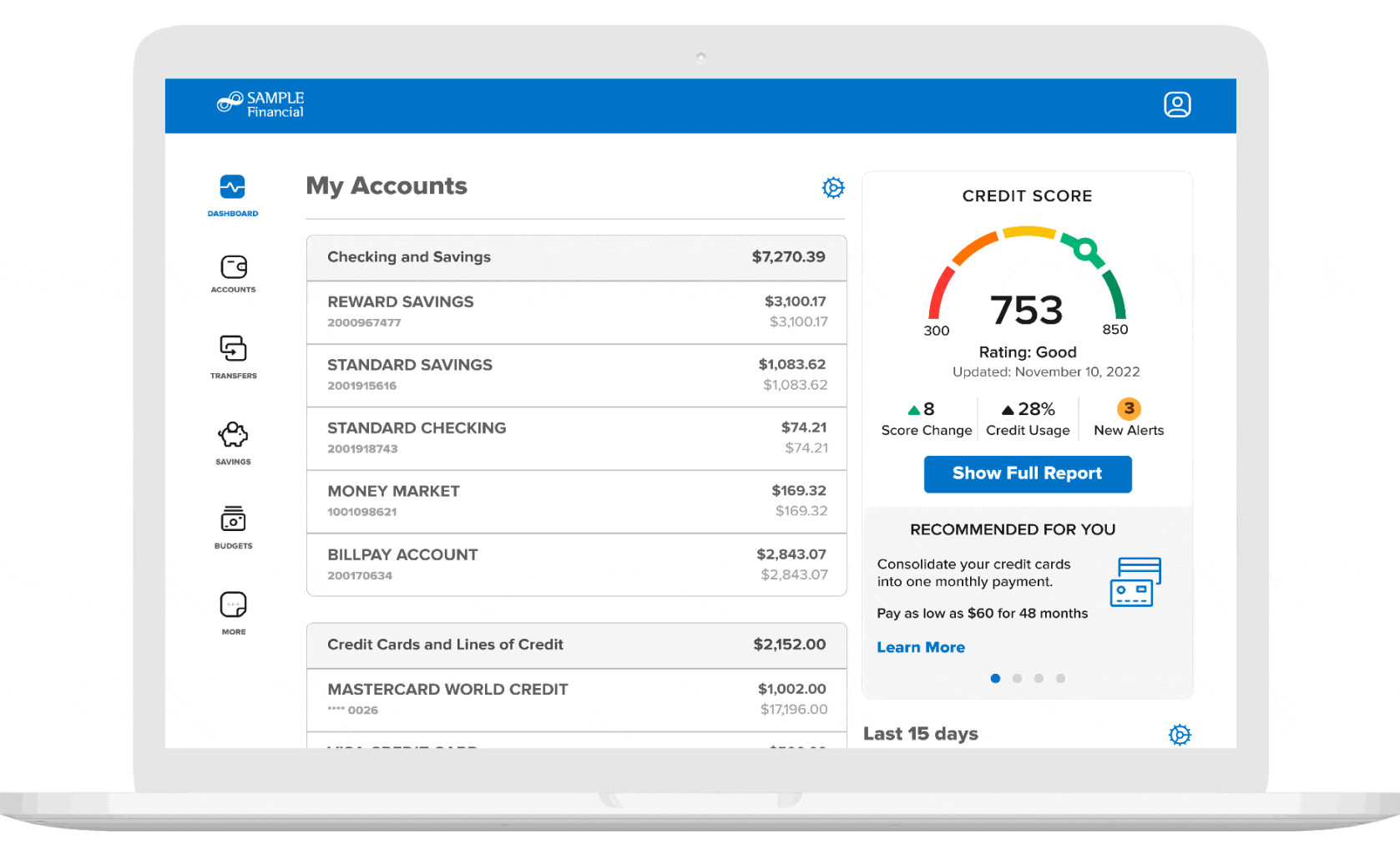

Unleashing Financial Empowerment: 10 Reasons to Integrate Credit Scores (and more!) within Digital Banking

Written by: Chris Fraenza In the ever-evolving digital banking landscape, staying ahead...

Forecasting the Future of Finance

Forecasting the Future of Finance: How will your credit union leverage fintech partnerships...

The SavvyMoney Difference.

Market-leading technology, actionable insights, and seamless integration all add up to a solid return on investment. That’s why we’re the trusted partner for banks, credit unions, and fintechs across the country.