![]()

The Board Says: Grow Your Deposits. Remember how things were in 2021? Budgets were open. Consumers were spending. Capital was flowing. Savings balances were at an all-time high. Your customers, members, and boards were ecstatic about the growth. According to the Federal Reserve, from the end of 2019 to Q4 2021, total deposits rose by more than 35%—an increase the Fed described as “outsized” compared to any other time in recent history.

But now, things are different. The mandate of “Grow Your Deposits” is here. In the last year, we’ve seen deposit levels decline for the first time since 1948. With the U.S. facing a perfect storm of growing economic uncertainty, financial institutions are hyper-focused on growing deposit volume to ensure they have adequate liquidity. And they need to achieve that growth without putting too much strain on marketing budgets. SavvyMoney is a leader in digital engagement and marketing solutions that helps financial institutions make deeper connections with their customers and members, has five-step plan can help you navigate the current financial waters.

Step 1. Focus on your best customers and members.

Finding deposit growth among your current customers and members is the easiest and most productive place to start: Research from PWC found banks can generate a 70% or greater return on initiatives that target existing customers. Current customers and members already trust your institution, and you have access to a large amount of data about them. Pairing your internal data with external information, such as size of wallet, helps you find the customers and members that have more to give. And knowing more about the products they have with other financial institutions will enable you to deliver more compelling, well-timed offers.

Step 2. Make them an offer they won’t want to refuse.

Want to make your customers and members an offer that’s too good to pass up? Personalization and relevance are key drivers of engagement and also help elevate your message above the competition. After all, a veritable firehose of great rates and offers is just a Google search away. Leverage the data you gleaned in Step 1 about accounts your customers and members hold at other financial institutions. What might tip them toward moving this business to you? Better rates? Better terms? More affordable fees? Product or service bundles they won’t find elsewhere? Also consider extending special offers to this high-value segment. What are you willing to give to grow your relationship?

Step 3. Leverage cost-effective marketing channels

Digital channels are the most cost-effective way to connect with current customers and members. In addition to email, consider targeted ads within your mobile app or online banking experience as this is likely where they most frequently engage with you. Keep in mind that it may take multiple touches through various channels to spur engagement.

Step 4. Make it easy to bank with you.

Customers demand seamless, frictionless, omni-channel digital banking experiences. Here’s how to make sure you can deliver:

- Minimize the pain of the channel switch. Assume your customers and members will use a variety of devices and ensure data easily crosses all channels. Having to redo an application or enter information more than once is incredibly frustrating.

- Optimize for mobile. A growing number of your customers and members do most, if not all, of their banking via a mobile device. A recent survey from Chase found that 90% of consumers manage all of their finances in one place with two out of three citing they “can’t live without their banking app”. If you don’t have a responsive website—i.e., one that adapts to the channel—it’s time to make that happen.

- Reduce form fields and clicks in each of your processes. You already have most of the information you need for existing customers and members. Streamlining the experience will minimize application drop-off and drive up your conversion rate.

Step 5. Use digital to build “sticky” customer relationships

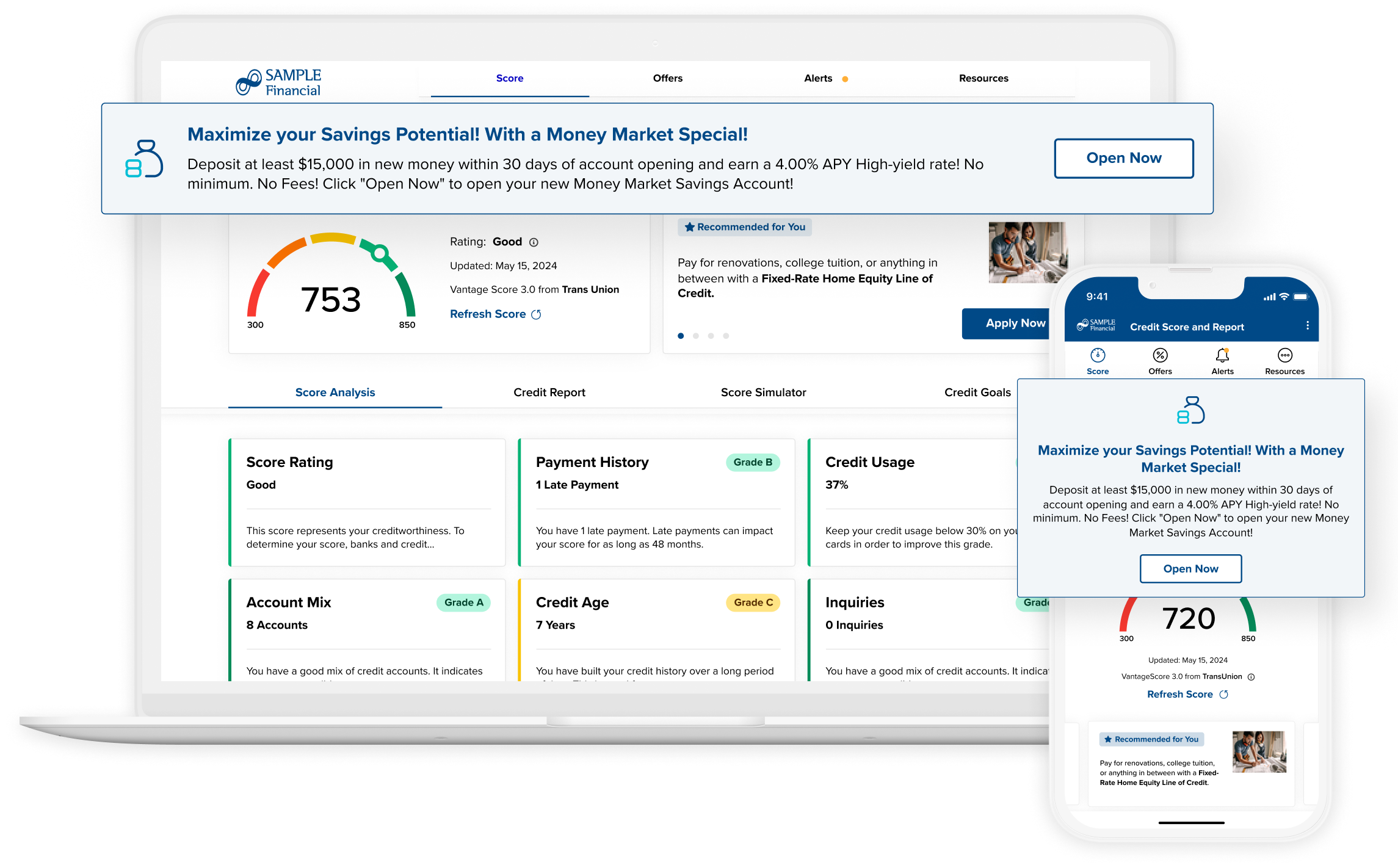

Retail banks that optimize their customer experience through digital have 3.2x faster growth than those that don’t. And nearly 90% of customers say the experience a company delivers is as important as the products, so optimizing digital engagement is critical to building stronger customer and member relationships. Partnering with a company that gives your customers and members a reason to engage with your financial institution on a regular basis can help you accelerate your five-step plan. For instance, SavvyMoney empowers your customers and members to actively manage their credit health.

Their API-based credit score and digital marketing solution integrates directly with your existing digital banking platform, enabling your users to easily monitor their credit scores, access highly-targeted money-saving offers, and improve financial know-how. All while giving you the data to grow your deposits and loan volume. Over 1,300 banks and credit unions use SavvyMoney to deliver more compelling digital experiences and these customers report higher levels of engagement. Using these five tips will establish a deeper connection with your customers, which will lead them to bring more business, including their deposits, to you. Being a true financial partner to your customers is key in today’s economic environment, and there’s no reason to believe that will change anytime soon. The more you learn about what your best customers need, the better you’ll be able to target, attract, and retain them.

Announce special savings account rates inside SavvyMoney

![]()