Background

Challenge

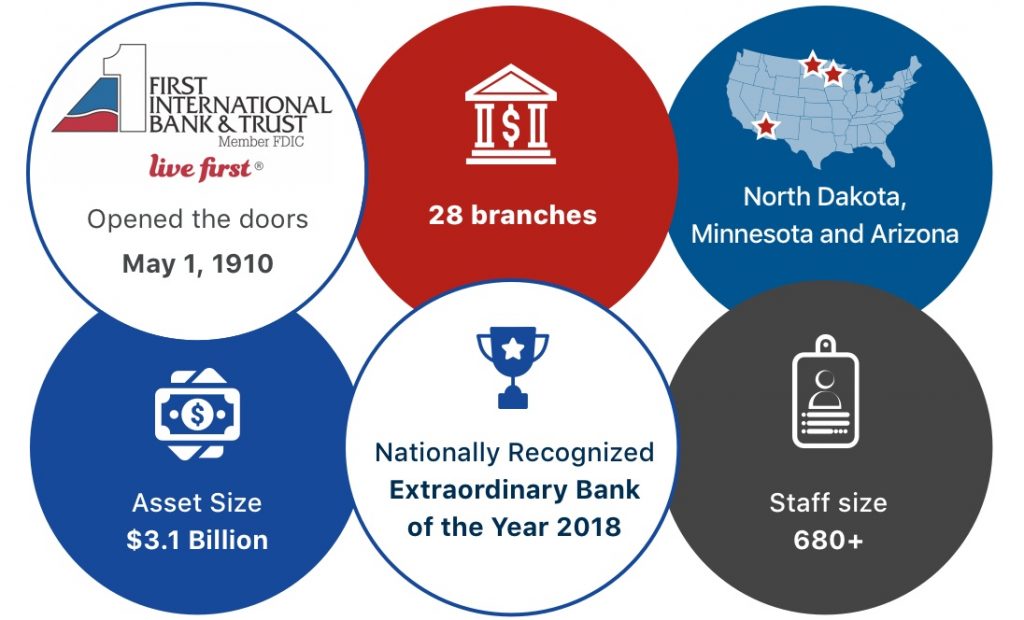

In response to growing fraud trends in the United States, First International Bank and Trust (FIBT) wanted to provide customers with credit score and report access along with a fraud monitoring solution. When they found that Credit Sense* combined score education and credit monitoring with the ability to show custom offers, they signed up for the solution.

SavvyMoney’s proprietary analytics truly enriched the solution! FIBT was very interested in running quick campaigns with minimal effort to capture highly qualified customers and increase non-interest income. Just in time for the holiday season, FIBT decided to run a credit card balance transfer campaign.

FIBT started by reviewing the easy-to-access credit score breakdown of their customers. The data gave them more insight into their audience and their behaviors, especially those with a credit score over 600, a segment they were interested in targeting with a pilot campaign. After reviewing the raw numbers, they began asking themselves, if their customers’ cards weren’t with First International, what financial institution were they using? A deeper dive into the analytics tool provided some great insight around those questions, as well as the breakdown based on their customers’ credit scores.

Solution

Credit Sense was the perfect solution for a data-driven financial institution. The analytics solution provides partners with insight into audience, behaviors, and credit profiles. No need to manipulate complex spreadsheets or reports—everything was accessible with a few clicks.

FIBT was able to run a well-thought-out campaign with minimal time and effort. After they looked at the breakdown of credit score segments, they followed the process below:

- Reviewed key lenders among their audience to learn whom their customers were borrowing from.

- Conducted focused market research on what the competition was offering.

- Structured a competitive offer that fit their target audiences.

- Promoted Credit Sense to their online and mobile banking users through an email blast. This step not only helped increase enrollment, but also triggered digital engagement, resulting in customers reviewing their credit score and customized offers.

- Sent out three targeted email blasts based on credit score, with the subject line: Recover from Holiday Spending with First International Bank & Trust’s Credit Card

- Tracked activity and ROI based on their customer segments and market research. An impressive 70 percent of the balances transferred were from their Top 10 credit card competitors where their customers held balances.

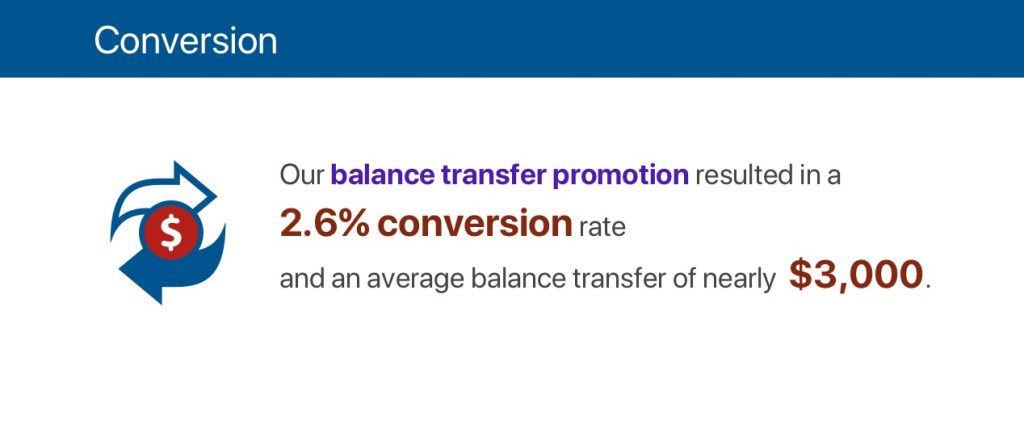

Data

Bottom Line

FIBT ran its very first digital campaign for credit cards. It was strategic, helped enhance their digital momentum, and was easy to execute while giving measurable results.

*Fiserv brands SavvyMoney’s Credit Score solution as “Credit Sense.”