Originally published by Fiserv.

SavvyMoney’s Credit Score Solution is branded “Credit Sense” in the story below.

The Goals

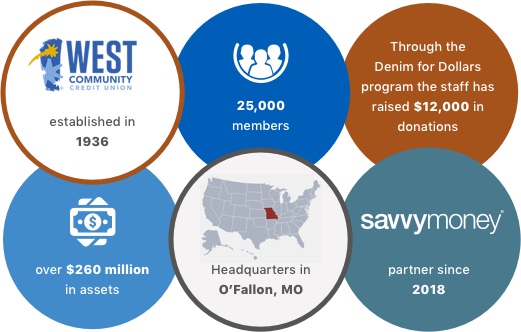

An existing Fiserv client of Mobiliti™, West Community Credit Union selected Credit Sense from Fiserv to provide members with a convenient credit monitoring service accessible through mobile banking. The credit union recognized Credit Sense, powered by SavvyMoney®, as a sticky service that could empower members with access to their credit score while driving digital engagement and providing increased opportunities to grow its lending portfolio.

Given that many third-party credit score sites also promote loan and credit card offers from competing financial institutions, West Community recognized the need to provide its members with a streamlined, convenient and educational credit score service.

The credit union also wanted a service that could integrate with its mobile banking platform to help drive digital engagement. As an existing Mobiliti client, West Community made the logical choice to implement Credit Sense as it could be easily integrated with mobile banking.

Meet Consumer Expectations for Convenient Credit Score Access

The ability to access and monitor credit scores is becoming increasingly important to consumers as they are more aware of data breaches and the risks of identity theft. Consumers also want to learn how to improve and manage their score with the goal of saving money, and the expectation is they should be able to obtain their score anytime it is convenient.

“We want to make sure our members are aware of their credit so that we can help educate them on ways in which they can improve their credit score,” said Sandy Carr, e-services manager for West Community Credit Union. “We also wanted to provide a service that would allow our members to easily access their score. Credit Sense makes this possible through integration with mobile banking.”

Credit Sense offers financial institutions the ability to provide consumers with valuable credit insights via access to their credit score, educational tools on improving their credit score, and monitoring via online or mobile banking. This value-added service helps build deeper and stronger member relationships, which is important to West Community.

“A credit monitoring tool or service is a sticky product,” said Carr. “We knew our members were going outside of our credit union to obtain their credit scores and we needed a streamlined service that would keep them with us.”

Drive Digital Engagement and Increase Cross-Selling Opportunities

“One of our primary goals is to increase the number of members who download and use our mobile banking app,” said Carr. “We saw Credit Sense as a tool that could help us achieve this goal and it is already moving us in the right direction.”

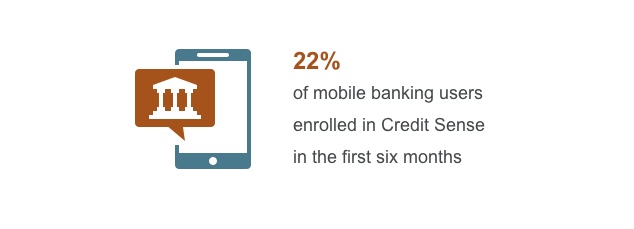

Since launching Credit Sense as a free, integrated service with its mobile app, West Community has been able to increase digital engagement and usage. The credit union has averaged approximately 100 new enrollments, and only one or two cancellations per month. Six months after implementation, 22 percent of the credit union’s mobile banking members had enrolled in Credit Sense, which surpassed expectations.

The credit union has also taken advantage of the increased cross-selling opportunities Credit Sense provides. In the first few months after go-live, the credit union had made over 700 loan or other credit offers to Credit Sense users. With the ability to deliver prequalified, targeted offers to users based on their credit score, Credit Sense can help financial institutions increase share of wallet and build deeper relationships with members.

“We view Credit Sense as an opportunity to potentially increase our products with loan origination,” said Carr. “We are just beginning to see results from the ability to present customized offers to Credit Sense users and we anticipate this will increase over time.”

Increase Membership Growth, Loyalty and Retention

“Many of our competitors feature mobile banking with mobile deposits but no one in our region offers credit score and credit reporting for free with their mobile app,” said Carr. “Being able to offer Credit Sense as an integrated and free service to members who download our mobile app provides a distinct competitive advantage over traditional and nontraditional competitors.”

In addition to driving mobile banking engagement, West Community has been able to attract new members through its marketing efforts promoting Credit Sense. “We have already started to see results in growing our membership as a direct result of offering Credit Sense,” said Carr. “And because Credit Sense offers a simple enrollment process, is easy to use and provides members with a valuable service they want, it can help to earn our members’ loyalty for greater retention.”

In addition to seeing their credit scores, West Community members who enroll in Credit Sense have access to financial literacy tools and resources designed to help them save money, learn financial management skills and participate in offers that can help lower their interest rates and/or payments. These additional services are an added benefit that increase the stickiness of Credit Sense.

Simple Implementation and Integration

“This was one of the easiest projects to implement from a back office and member perspective,” said Carr. “Working with SavvyMoney and Fiserv was a very smooth process requiring minimal effort on our part.”

There also was minimal internal training required. “Credit Sense is user-friendly and the navigation is easy so there was little need for training,” said Carr. “We provided our staff members with talking points on how Credit Sense is a differentiator and explained the benefits.”

When asked what advice the credit union has for financial institutions considering a credit monitoring service, Carr said, “If you are looking to drive digital engagement, go with a service that can integrate with your online or mobile banking app. For us, integration with our mobile app is a key benefit of Credit Sense.”

Challenge

West Community Credit Union was seeking a way to differentiate itself from its competitors by offering a credit monitoring service that members could access through its mobile banking service.

Solution

The credit union implemented Credit Sense, an integrated and convenient credit monitoring solution that helps increase customer loyalty, digital engagement, and loan portfolio growth opportunities.

Proof Points