Partner Background

Challenge

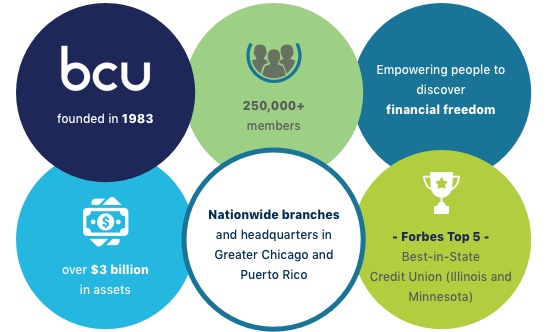

Baxter Credit Union (BCU) is continuously working to achieve its purpose of empowering people to discover financial freedom. To align with its beliefs, the credit union began to develop financial well-being content, which it consistently shared as a way to improve financial wellness. Rather than simply pushing out static content, they wanted to personalize the experience and the content they disseminated to the member.

BCU created Life. Money. You.® a personalized financial education program designed to help members achieve their financial goals. SavvyMoney Credit Score and Report played a major role in delivering personalized content to members about their credit. This, along with Financial Health Dashboards made for more personalized and engaging experience where the results could be measured.

Solution

BCU executed a partnership with SavvyMoney in 2015. Credit Score provides an engaging platform to teach members about their score, beyond just showing them a number. As an example, the credit report card includes personalized tips on improving one’s score along with their personal trends overtime. The credit report card teaches members about their optimal credit utilization rates, members can see key information about their payment history, to understand accounts in good standing. Members are able to easily find ways to identify savings opportunities. The downloadable full credit report is used by the member to take a deeper dive into their accounts and work toward a financial goal, sometimes through the input of a credit counselor.

Years later in addition to SavvyMoney BCU launched the Life. Money. You.® initiative which had three major components:

Interactive, engaging content:

BCU added quizzes before and after financial well-being content.

Credit education:

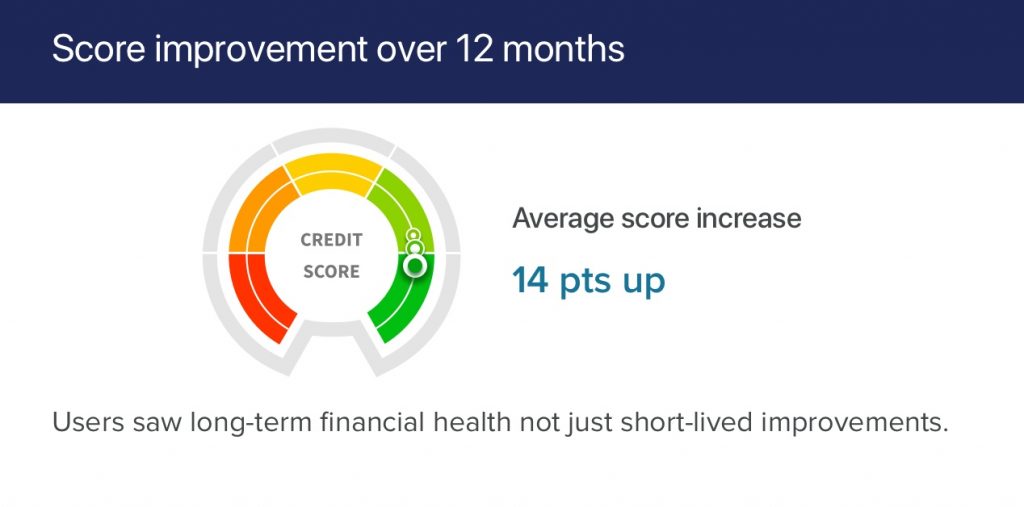

Providing members individualized rather than static information on their credit allowed BCU to track credit improvement over time and progress toward the goal of helping members achieve financial freedom.

In addition to the credit score dashboard, and aligning with its purpose, BCU leveraged infographics and blog posts from SavvyMoney Director of Education Jean Chatzky.

1:1 counseling:

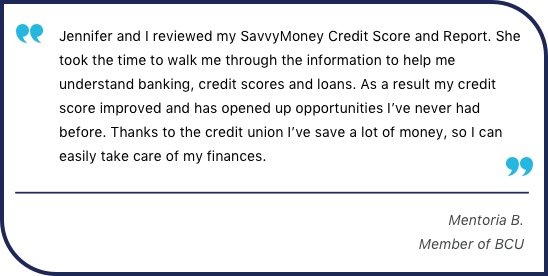

SavvyMoney provides an easy to understand credit report that can be printed in the branch. The report summarizes trade lines, payment history, utilization rates, in a manner not found in a commercial credit report. BCU credit counselors in each branch love to use it in conjunction with the credit report card as a guide to discuss with members methods to improve their score.

Member Story

Mentoria, one BCU member shared her credit report from SavvyMoney with one of BCU’s Goal Consultants, Jennifer. Together, they established a plan and within 12 weeks, she increased her score 78 points. Plus, she qualified for an auto loan she was previously unable to qualify for.

Data Measuring Financial Wellness

Data Measuring ROI

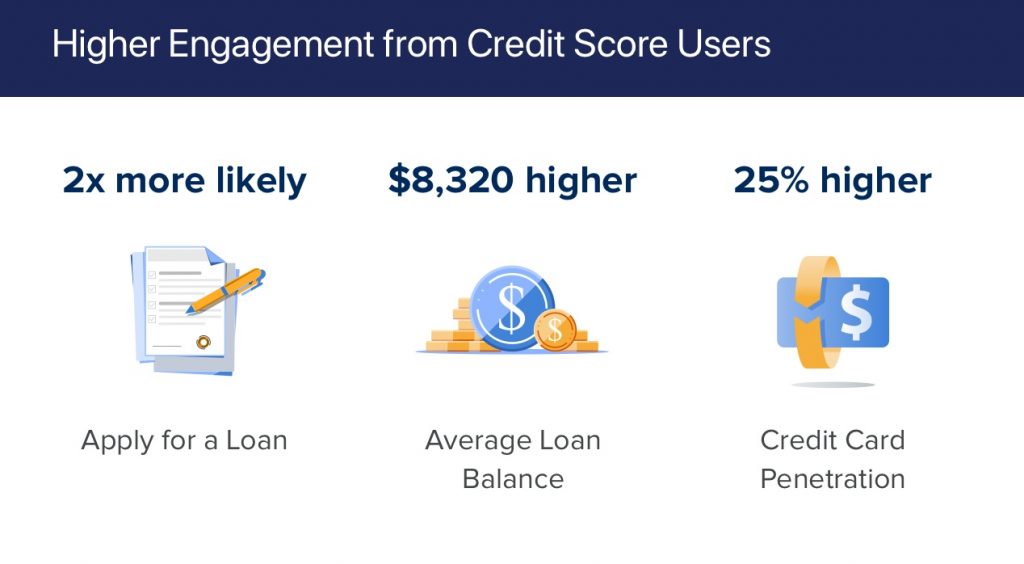

Members who are financially fit are able to take out loans responsibly with the best rates. Their ability to be approved for new credit helps a financial institution like BCU maintain their commitment to the community they serve.

The SavvyMoney solution shows prequalified offers which save members money, and help increase application rates. SavvyMoney users are more engaged, maintain higher balances, utilize more products, and are overall more profitable.

Bottom Line