Background

The Goal

Dupaco Community Credit Union is driven by its mission to improve their members’ financial position. Through their one-on-one Credit History Lessons, Money Makeovers, and Credit Coach loans, they knew how powerful credit score education was in helping members build or improve their credit scores—and gain access to better interest rates. Motivated by their mission, Dupaco sought a partner who could provide their members with online credit score access and tools to help improve their financial lives.

The Solution

SavvyMoney’s credit score solution empowers users to take control of their financial future with easy-to-understand, actionable credit advice. Dupaco recognized that SavvyMoney was mission-aligned and could seamlessly integrate with Dupaco’s digital banking and loan origination platforms. Dupaco also found tremendous value in SavvyMoney’s personalized pre-qualified offer engine, which had the potential to yield a return on their investment. After careful consideration, a partnership was formed in 2015.

According to Sherry Leeser, Dupaco’s Vice President of Marketing Intelligence and Strategy, Dupaco is strategically focused on delivering relevant and timely member messages through robust data analytics. Leeser stated, “The SavvyMoney offer engine stood out from others because it allowed us to pre-qualify our members based on numerous data attributes to ensure they only received offers that could save them money or provide additional education. This partnership offers a win-win; the member only sees meaningful offers that may save them money, and Dupaco is able to fulfill their mission to improve their members’ financial position while achieving a return on their investment.”

Dupaco branded the credit solution “Bright Track” and provides it free as a benefit of membership. Member benefits include:

- Credit Score Report Card: Assigns a letter grade to each of the five components that make up the members credit score, with tips for improving or maintaining their score.

- Credit Monitoring: Provides personal ongoing credit monitoring, with individualized alert emails to better guard against identity theft and to prevent credit report errors.

- Savings Opportunities: Recommends personalized pre-qualified offers that are aligned with the member’s credit profile and could yield money-saving opportunities.

- Trending: Displays the member’s credit score trend since joining Bright Track and compares them to others in the geographic region.

- Credit Report: Offers a full credit report with a detailed view of the member’s credit history, account detail, payment history, bankruptcies, and other potentially derogatory items.

At the start of the partnership, Dupaco invested in extensive training across all levels of the credit union. They encouraged every employee to enroll and test the product. Since that time, Dupaco has fully incorporated Bright Track into all credit union channels. From online articles discussing fraud and the importance of checking your score and report, to branch teams discussing the same information with their members, Bright Track is a part of their brand and culture. Additionally, Bright Track authentication is a basic part of their in-branch new member onboarding process.

Results

Members get their credit score, advice and personalized pre-qualified offers from Dupaco, not the competition. The data shows ROI through members increasing their business with Dupaco and improving their credit scores.

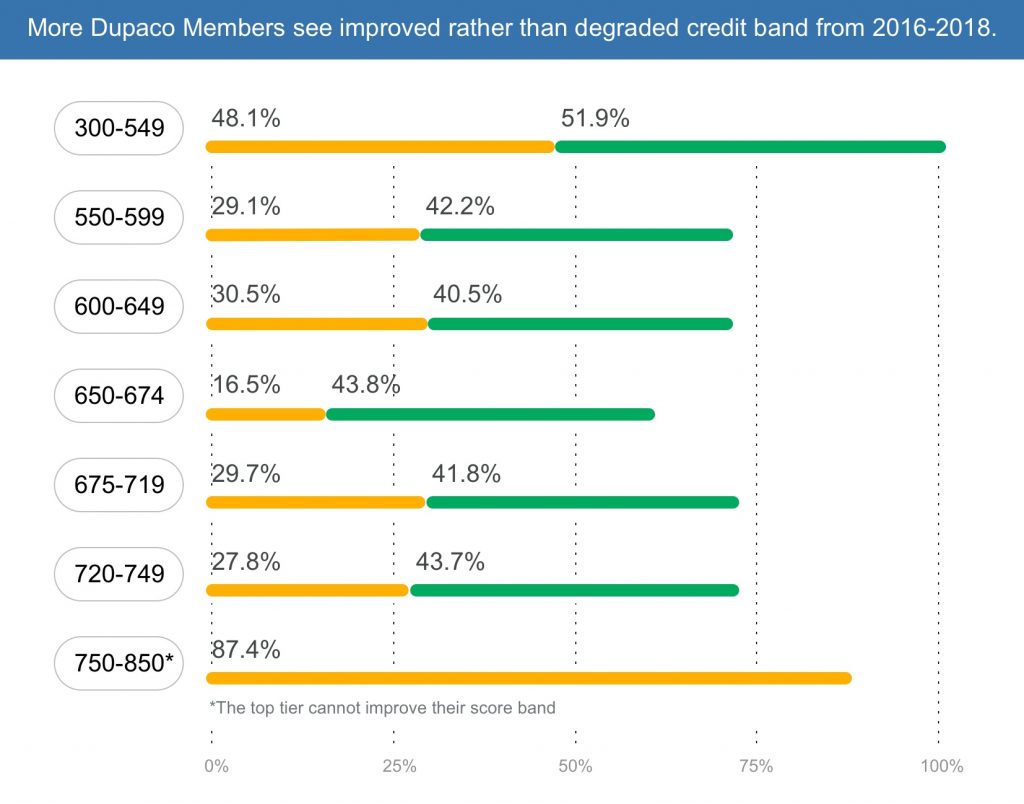

77% of enrolled members improved or maintained their credit score range over 12 months, fulfilling Dupaco’s goal to improve their members’ financial position. This chart shows the credit improvement or consistency broken down by score band.

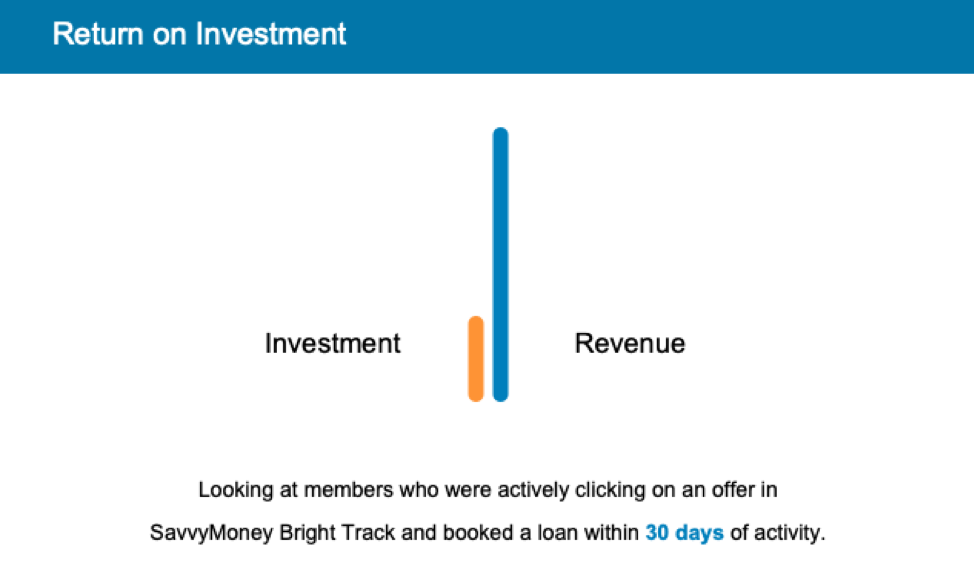

* Total SavvyMoney user costs (investment) during 4 years compared to SavvyMoney influenced loan revenue (member clicked Savvy Money offer and booked loan within 30 days of the click). Mortgage, home equity, “other retail” loans, and deposits are excluded.

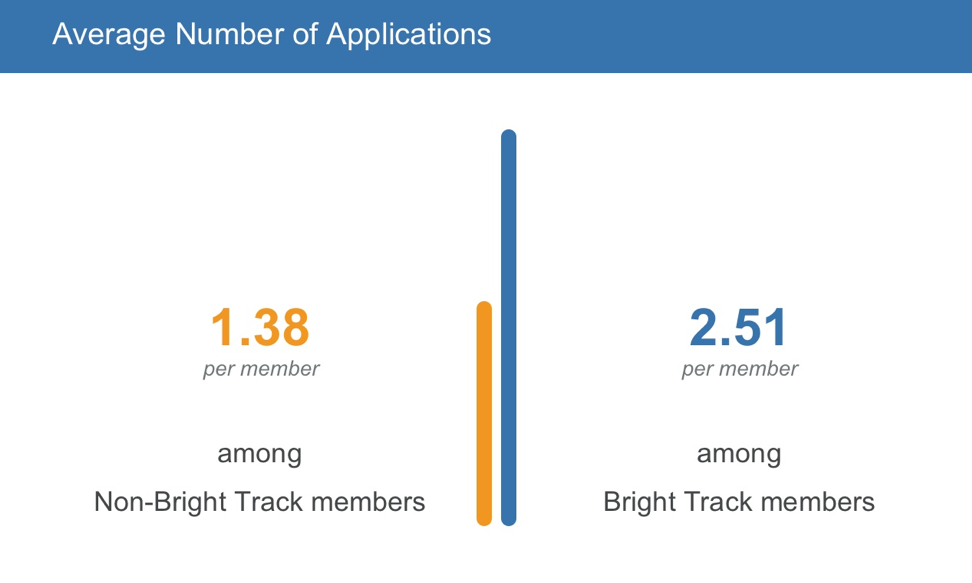

Bright Track users are nearly 2 x more likely to apply for a loan compared to non-users making it important to shield them from competitor credit score platforms to prevent against attrition.

Timeframe

Dupaco conducted extensive staff training and member awareness campaigns when Bright Track rolled out. Staff and members quickly caught on and within the first 10 months, annualized Bright Track revenue covered expenses. The ramp up was fast, and results were quickly visible. SavvyMoney and Dupaco meet on a regular basis to review member engagement and offer performance. The data indicates the ROI has continually grown over the 4-year partnership, which continues strong today.

The Bottom Line

Dupaco implemented SavvyMoney’s credit score solution to help members understand their credit score and to provide them the opportunity to improve their financial position. The data reveals that those who enroll are in fact improving their credit. It also shows them applying for and funding more loans than nonusers of Bright Track. Overall, Bright Tracks users are more profitable and credit savvy than nonusers, contributing to the positive ROI.